Federal Tax Incentive Updates

The IRS announced today a change to the MSRP caps. These allow for more vehicles to be qualified for the clean vehicle tax credit. Here’s the current list of vehicles that qualify for the credit.

Plug-In Hybrid

Audi Q5 TFSI e Quattro

BMW 330e

BMW X5 xDrive45e

Chrysler Pacifica Plug-in Hybrid

Ford Escape Plug-in Hybrid

Jeep Grand Cherokee 4xe

Jeep Wrangler 4xe

Lincoln Aviator

Lincoln Corsair Grand Touring

Volvo S60 Recharge Extended Range

All-Electric

Cadillac Lyriq

Chevrolet Bolt EV/EUV

Ford F-150 Lightning

Ford Mustang Mach-E

Ford E-Transit

Nissan Leaf

Rivian R1T and

Rivian R1S

Tesla Model 3

Tesla Model Y

Volkswagen ID.4

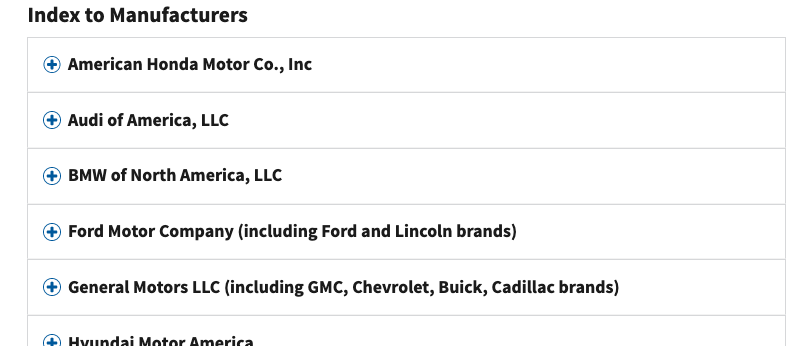

Actual credit eligibility can vary, based on actual MSRP. For the latest, visit the Manufacturer Index on the IRS Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2023 or After page. Click the (+) to view the vehicle information.

Visit Plug In America’s EV Tax Credits page for consumer-friendly guidance and Incentives page for information on Hawaii and Federal incentives.